We have crept right into spooky season, where strangeness is celebrated and candy is shared. (I personally tend to dig through the gathered mounds of treats for a Mars Bar or two.)

The financial patterns of late seem to be doing some scaring of their own. This blog has the purpose of hopefully putting some fears at ease.

First things first,

What financial patterns are spooky these days and why?

- Increasing Interest Rates

- Increased interest rates cause debt to cost more. This may include open mortgages or mortgages on renewal, lines of credit, etc.

- Inflation

- Everything is costing more. Groceries, utilities, fuel and the list goes on. The more things cost, the less there is to pay down debt, invest or enjoy!

- Market Volatility

- When markets go up, this makes our portfolios look nice. This only really benefits you if you are in a place to withdraw your investments.

- When markets go down, we see the value of our portfolio (for retirement or other needs) drop. This can cause fear and uneasiness.

How can these financial problems be combated?

- Financial Planning

- A great tool to keep in your toolbelt for uncertain times is a financial plan. A financial plan can assist with understanding your situation. Once a plan is in place, it is good to review it, and make sure you stick to the plan, unless your circumstances have changed.

- Interest rates

- Hopefully when you took on the debt, you were informed that the rates could change and if they increase your monthly costs could as well. If you are in a position where you can’t afford the debt, talk to an advisor and see where you can cut debt.

- Start paying off the smallest amount of debt. This gives you a quicker “win” and when it is paid, the saved payment can be added to your next smallest debt.

- Inflation

- Rising costs on daily needs can be frustrating and hard to control. Make sure you build and maintain a budget. A budget will assist with seeing areas that you can cut costs. This may include reducing “wants” (Starbucks, movies, eating out, etc.) or talking to an insurance broker to reduce costs through bundling home/auto, etc. together.

Side Note: Our Thanksgiving Blog also gave ideas to be able to save money during the holidays. These will also be relevant as we move into the Christmas season.

- Market Fluctuations

- If markets stay steady, no one makes any money. We need ups and downs to make money.

- A couple of ways to reduce fears is to:

- Set up monthly contributions to your savings accounts. This makes it so you don’t have to study the markets and determine the best day to contribute (on low days). None of us have a crystal ball to see what tomorrow may bring. Start regular contributions now so you are in a good habit of paying yourself first and investing to assist with meeting your future financial goals (retirement, travel or the family legacy!).

- Utilize investments that guarantee a minimum amount that can be returned to you. Seg. (segregated) funds provide death and maturity guarantees. These guarantees are a great way to plan for retirement and estate planning and assist with sleeping habits when markets are volatile.

What is a similar financial situation that has happened in the past? How did they “survive”?

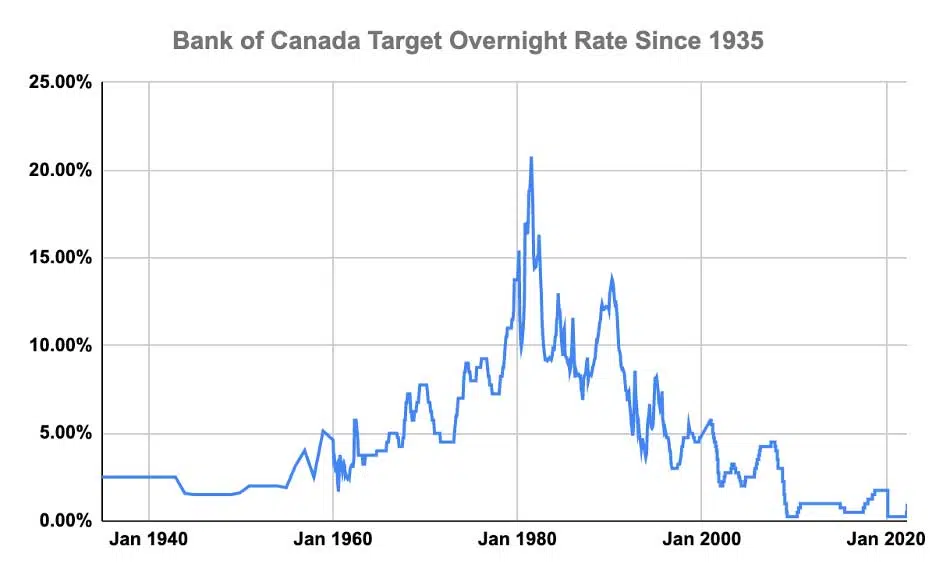

Interest rates and inflation often fluctuate. This is normal and is caused by many factors, close to home and globally. For example, we are currently hearing a lot about rising interest rates. Did you know that our current rates are similar to what we experienced in 2008, and we weren’t fearful at that time. It is a good idea to talk to an advisor to find out what is causing rates to change and where they may be headed before living in fear. The rates we have experienced over the past number of years are much lower than historically high rates. It is not unexpected that they have been increasing (see following chart).

Market fluctuations are also a normal way of life and we have survived! Again, stick to your plan. If you plan to need your investment portfolio in the next 12 – 18 months, then you will want to talk to your advisor and find out your best options. If your timeframe is 24 months and beyond, stick to your current plan.

If you want further insight on these spooky situations, contact my office to book an appointment and we can discuss what your best options are.

Be spooked by a haunted house, not finances. 🙂